China’s Estimated Intervention in February

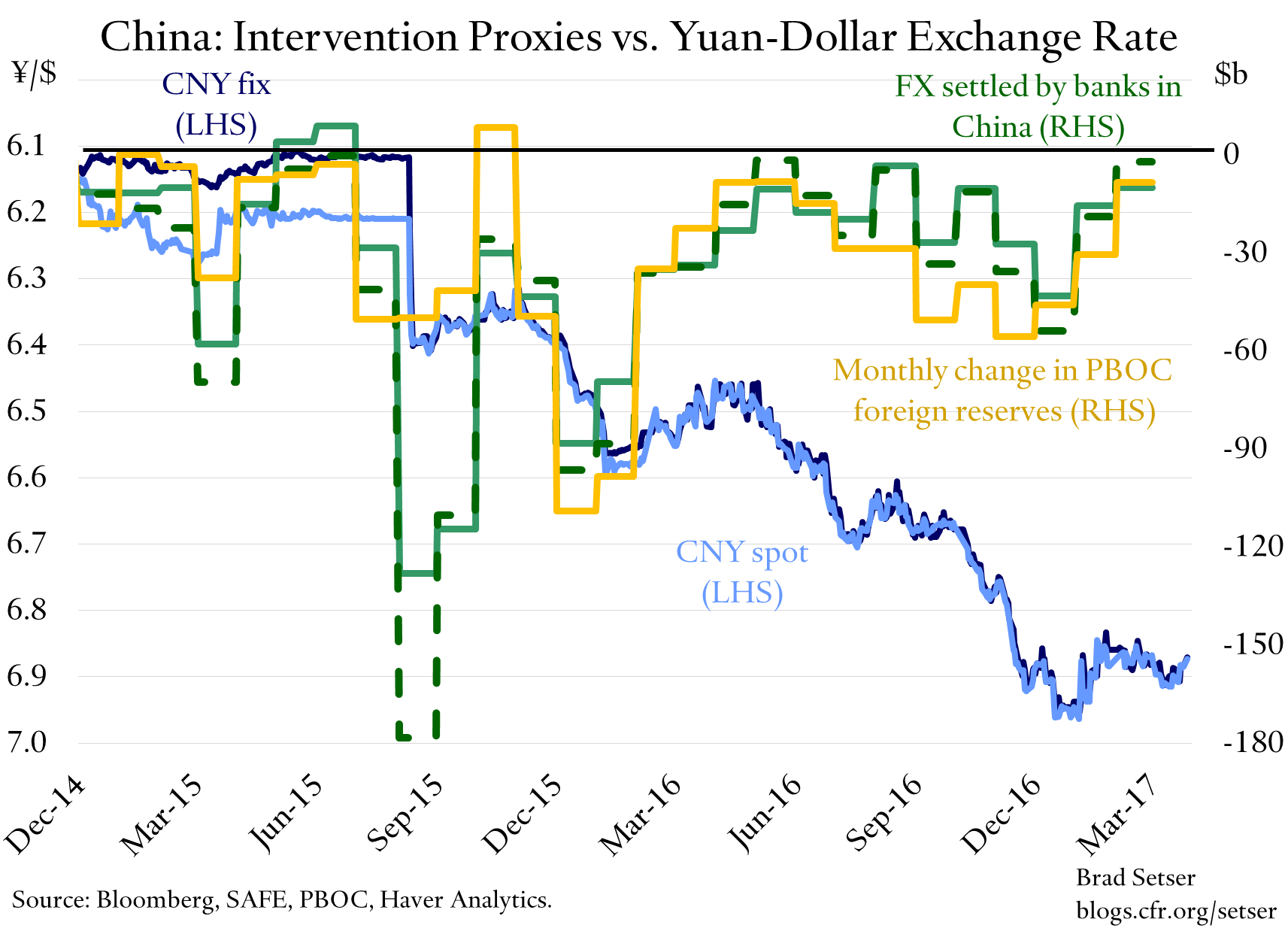

The proxies for Chinese reserve sales show very modest sales in February. Foreign exchange settlement (which includes the state banks) shows $10 billion in sales, and only $2 billion counting forwards. The PBOC’s balance sheet shows similar changes—foreign reserves fell by $8.5 billion and foreign assets fell by $10.6 billion. No wonder the (fx) market is no longer focused on China.

More on:

The fall off in foreign exchange sales is particularly impressive given that China didn’t have its usual trade surplus in February, for seasonal reasons (China’s trade often swings into deficit during the lunar new year). Modest reserve sales alongside a monthly trade deficit imply that the pace of capital outflows fell.

The only analytical problem is that the fall in pressure on the renminbi is a bit over-determined.

Controls on outflows were tightened. For real, it seems. That likely helped.

And the yuan was stable against the dollar, broadly speaking. There continues to be a correlation between movements in the yuan and the pace of outflows.

More on:

In other words, to stabilize outflows, it really helps if China at least keeps the yuan stable against the dollar. Any depreciation (against the dollar) tends to generate expectations of more depreciation. Chinese firms with dollars want to hold on to them. And so on. Appreciation against the dollar by contrast tends to encourage firms with dollars to sell their dollars and bring their money home. The interest rate on the yuan is higher than on the dollar remember; holding dollars can be costly.

The data for March won’t be out for several more weeks. Given the dollar sold off a bit in March, allowing the yuan to rise a bit against the dollar within the broad context of managing against a basket—there is no strong reason though to think pressure on the yuan has returned. One implication: the money market tightening in China likely was done for domestic reasons, not as a by-product of an effort to support the currency.

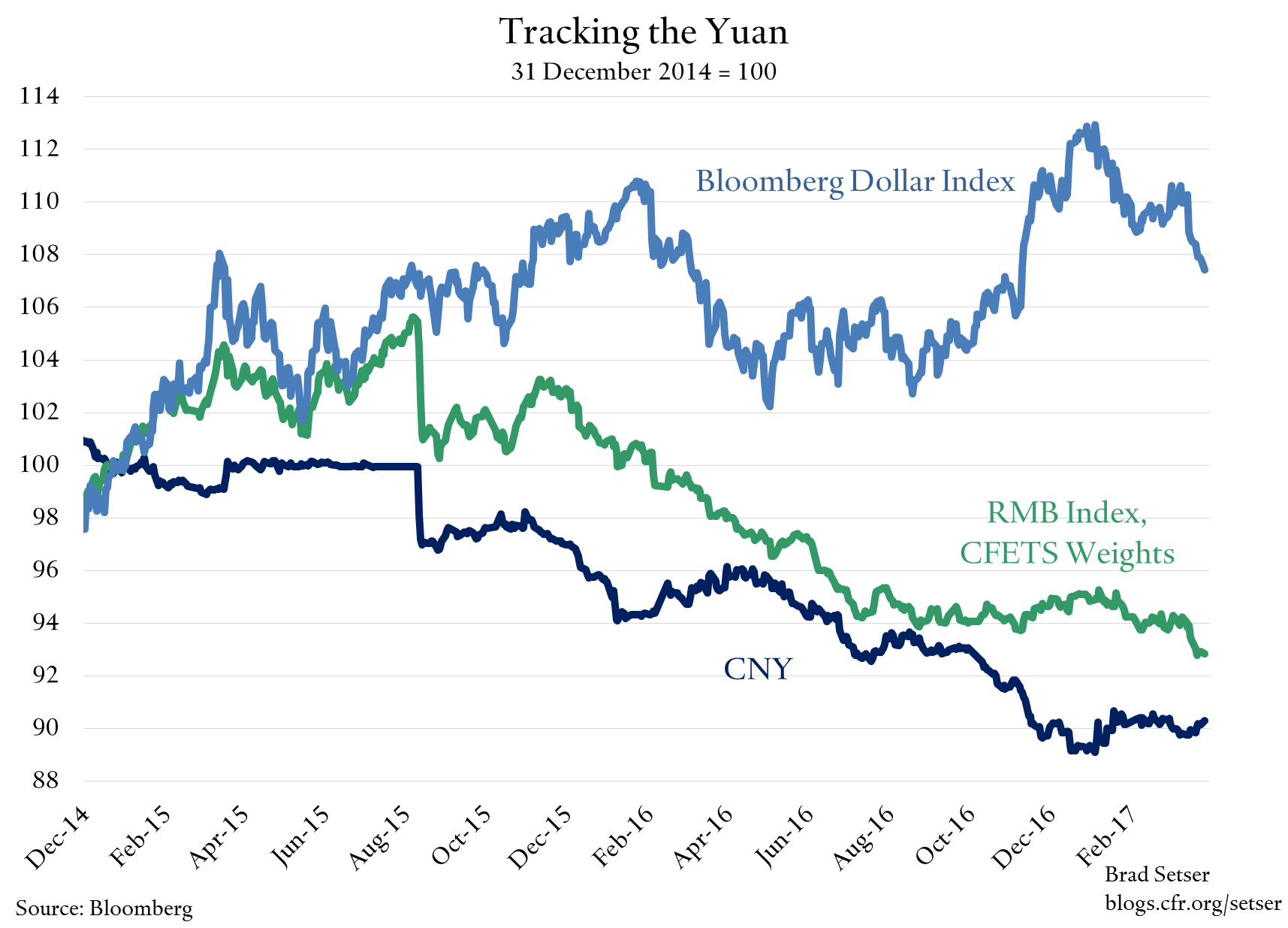

I though do wish that China had been a bit symmetrical in its management against the basket, and had not (once again) used the dollar’s weakness as an opportunity to let the yuan slide (a bit) against the CFETS basket (see the chart above). China needs to add to the two way risk around the yuan. That will not happen if the big players in China’s foreign exchange market think the yuan will be stable against the dollar when the dollar is going down, and will depreciate against the dollar when the dollar is going up (and thus grind down against the basket).

So in my view, China either missed an opportunity to let the yuan rise a bit more against the dollar and add to two-way risk, or signaled that it has reverted to managing the yuan against the dollar once again.

Online Store

Online Store